Macroprudential policy

Objectives

The primary objective of the BM's macroprudential policy is to ensure the preservation of financial stability by strengthening the resilience of the banking system and preventing systemic risk, the latter being the risk of financial service disruptions caused by problems in some or all institutions of the financial system, having severe negative consequences for the real economy.

In order to achieve the primary objective of macroprudential policy, the following intermediate objectives have been established:

- Prevent and mitigate excessive credit growth and excessive leverage;

- Prevent and mitigate excessive maturity mismatch and absence of liquidity in the market;

- Limit excessive risk-taking by systemically important institutions; and

- Limit direct and indirect concentrations of exposures.

Instruments

The BM's macroprudential policy instruments are as follows:

- Instruments to prevent and mitigate excessive credit growth and leverage:

-

- Countercyclical capital buffer;

- Sectoral capital requirements;

- Loan-to-Value (LTV) ratio;

- Loan-to-Income (LTI)/Debt-to-Income (DTI) ratio;

- Leverage ratio ceilings.

- Instrument to prevent and mitigate excessive maturity mismatch and absence of liquidity in the market:

- Loan-to-Deposit ratio.

- Instrument to limit direct and direct exposure concentrations:

- Restrictions on large exposures.

- Instrument to limit incentives to the undertaking of excessive risk by systemically important institutions:

- Additional capital requirement for systemically important institutions.

Macroprudential policy implementation framework

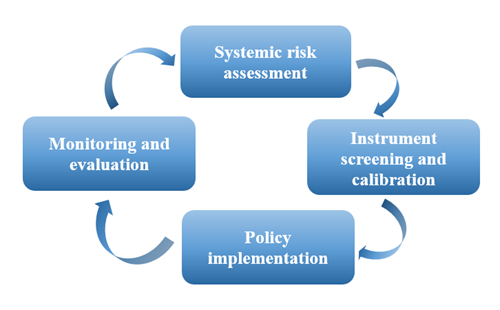

The Banco de Moçambique shall take macroprudential action through a set of several steps, namely systemic risk assessment, instrument screening and calibration, policy implementation, communication, as well as monitoring and evaluation (see figure 1 below).

Fig. 1: Macroprudential policy implementation cycle.

Decision-making process

Macroprudential policy decisions shall be taken by the Financial Stability and Inclusion Committee (CEIF). The Committee convenes once a quarter for this purpose, and may convene extraordinarily at any time, if conditions so require.

The Financial Stability and Inclusion Committee screens instruments regarding their degree of effectiveness, with a view to eliminate sources of systemic risk and application transparency.

Communications

The BM shall periodically inform the public of its assessment of the financial system's vulnerabilities, policies and measures adopted to mitigate eventual sources of systemic risk, as well as its overview of the financial system.

To this end, the Financial Stability Report (REF), the Financial Stability Bulletin (BEF) and the Report on the Identification of Domestic Systemically Important Banks[1] (D-SIBs) are drawn up and published regularly, in accordance with BM current communication policies, as well as the best practices concerned.

If required, more timely and shorter communications (notices or short communiqués) can be released to the market concerning a specific event that may be ongoing, so as to prevent systemic risk accumulation and ensure the timeliness of the communication to the public.

Macroprudential measures in effect

To mitigate systemic risk, the BM has laid down the following macroprudential measures:

- D-SIB capital conservation buffer set at a minimum of 2.0%;

- Capital conversation buffer for quasi-systemically importance domestic banks (quasi D-SIBs) set at 1.0%;

- 100% LTV indicator limit for lending to customers of credit institutions and financial companies (ICSF);

- 100% DTI indicator limit for lending to customers of credit institutions and financial companies;

- Establishment of the countercyclical capital buffer as an instrument for preventing and mitigating excessive credit growth and leverage.