MIMO POLICY RATE REDUCED TO 9.25 %

The Monetary Policy Committee (MPC) of the Banco de Moçambique has decided to reduce the monetary policy rate, MIMO, from 9.50% to 9.25%. Read More

The Monetary Policy Committee (MPC) of the Banco de Moçambique has decided to reduce the monetary policy rate, MIMO, from 9.50% to 9.25%. Read More

The Banco de Moçambique (BM) was established in 1975 by Decree No. 2/75 of May 17, in light of the commitments undertaken in the Lusaka Accords in 1974. Read More

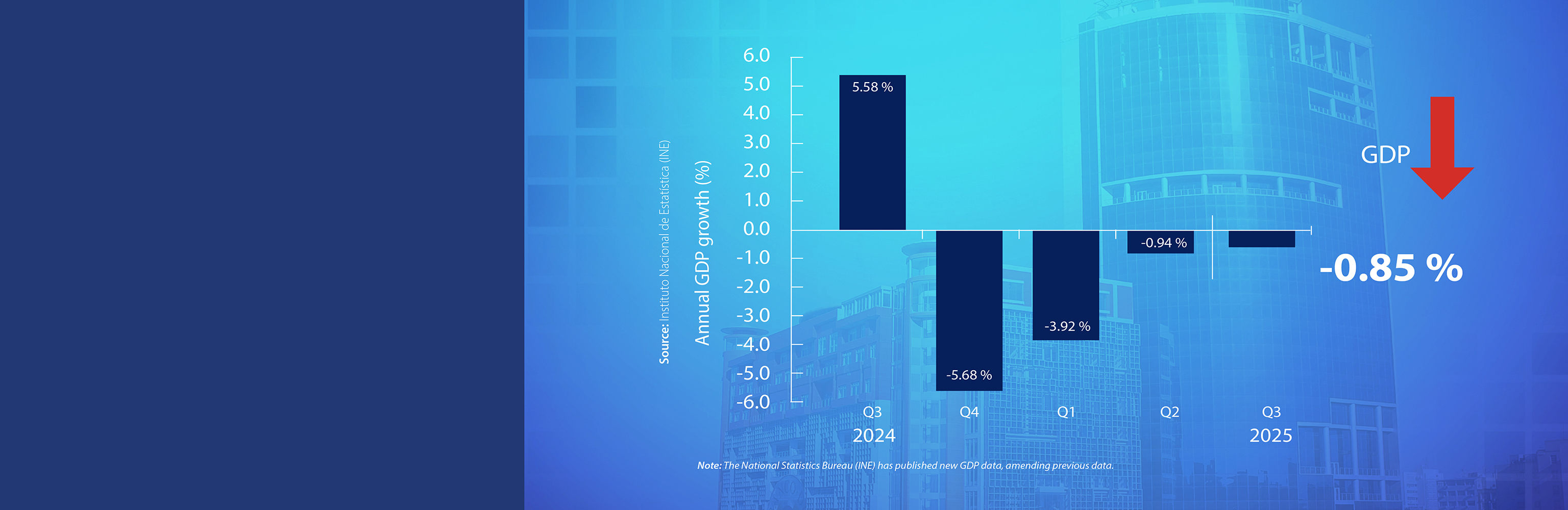

The decline in economic activity in the second quarter of 2025. Read More

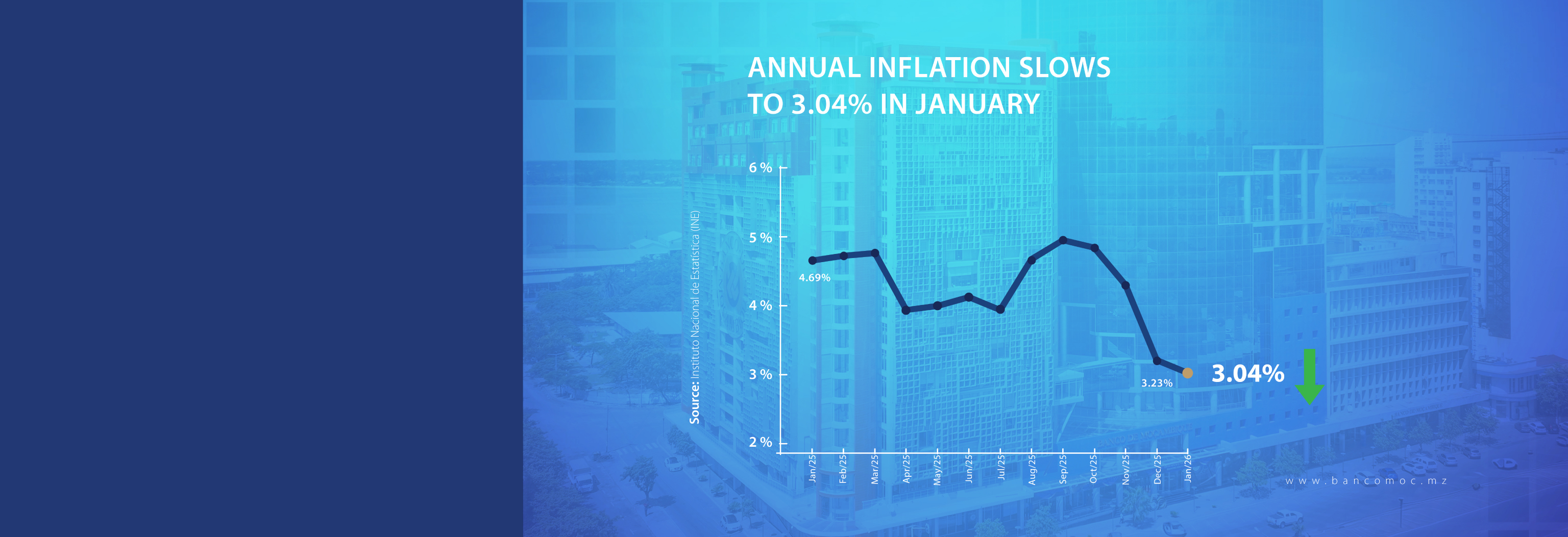

Food and non-alcoholic beverages and transport were the main contributors to the slowdown in annual inflation in January. Read More

Preserve the value of the national currency and promote a sound and inclusive financial sector. Read More

*Currency data is provided in real time

Exchange Rates

Last Update:

| Currency | Buy | Sell |

|---|

Interest Rates

Currency

Variation of Inflation Rates

Quarterly Change in Real GDP

QUICK ACCESS